nebraska inheritance tax rates

More distant relatives pay 13 tax after 15000. Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs.

Estate Tax Rates Forms For 2022 State By State Table

Others pay 18 tax after 10000.

. Until this TABLE 1. Close relatives pay 1 tax after 40000. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000.

According to a local law firm When a person dies a resident of Nebraska or with property located in Nebraska the Nebraska county inheritance tax will likely apply to the decedents property. County of Box Butte 169 Neb. For purpose of inheritance tax property should be valued at amount of money which it would produce if offered and sold for cash at time of death of decedent.

When a person dies a resident of Nebraska or with property. Search a wide range of information from across the web here. Late payments can also result in penalties of 5 per month up to 25 maximum of the unpaid tax.

In fact Nebraska has the highest top rate at 18. Close relatives pay 1 tax after 40000. More distant relatives pay 13 tax after 15000.

In fact Nebraska has the highest top rate at 18. For transfers to immediate family members not including spouses the inheritance tax rate is 1 on the value of the property that passes to each person over an exemption amount of 40000 per person. All Major Categories Covered.

Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away. Anything above 15000 in value is subject to a 13 inheritance tax. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them.

Others pay 18 tax after 10000. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Who are the remaining persons receiving inheritances.

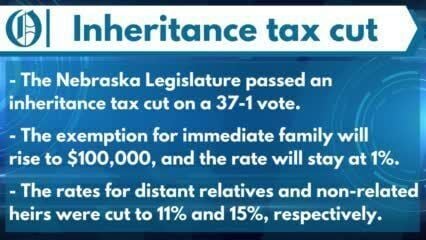

The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023. How is this changed by LB310. Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away.

Add the base payment to that figure and your total tax bill comes to 3073800 for this estate. Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs. Select Popular Legal Forms Packages of Any Category.

The inheritance tax does not currently apply to transfers to a surviving spouse. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023. If the tax is not timely paid then interest starts accruing at a rate of 14 per year.

There are only six states in the nation that levy an inheritance tax and Nebraska is one of them. That exemption amount and the underlying inheritance tax rate varies based on the inheritance. Nebraska Inheritance Tax Exemptions and Rates.

Charitable organizations are usually exempt. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests. Nebraska Inheritance Tax Exemptions and Rates.

Who are the remaining persons receiving inheritances. There are only six states in the nation that levy an inheritance tax and Nebraska is one of them. What is inheritance tax do you pay in Nebraska.

Any inheritance tax due must be paid within one year of the decedents date of death. However for transfers to other immediate family members eg children grandchildren siblings parents etc the inheritance tax rate is 1 on the fair market value of. An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section.

Inheritance Tax Rates by State Ranked by Bracket ChildRateNephewNiece Non-RelativeRate Rate 1. Certain kinds of assets are not subject to Nebraska inheritance tax no matter who inherits them. For states to immediately amend their inheritance tax laws into progressive structures and many states that had not yet levied the tax added it to their tax rolls.

What is inheritance tax do you pay in Nebraska. 311 99 NW2d 245 1959. Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others exempt these relatives.

You are in the highest tax bracket and you owe a 345800 base payment on the first 1 million of your estate. Ad Inheritance and Estate Planning Guidance With Simple Pricing. When a person dies a resident of Nebraska or with property.

Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs. Anything above 15000 in value is subject to a 13 inheritance tax. How is this changed by LB310.

In fact Nebraska has the highest top rate at 18. Transfers to immediate family members other than the surviving spouse -- The tax rate on transfers to immediate relatives eg children grandchildren siblings parents etc will remain 1 however the exemption amount will increase from 40000 to 100000 per beneficiary. Beyond that the Nebraska inheritance tax is as follows.

Certain kinds of assets are not subject to Nebraska inheritance tax no matter who inherits them. You also owe 40 of the remaining 682 million which comes to 2728 million. Charitable organizations are usually exempt.

Ad Find Visit Today and Find More Results. Nebraska inheritance tax is computed on the fair market. The inheritance tax must be paid within 12 months of the date of death otherwise interest accrues at 14 with penalties of 5 per month up to 25 of the tax due.

FEDERAL ESTATE TAX RATES. Surviving spouses are exempt. Currently the first 15000 of the inheritance is not taxed.

Currently the first 15000 of the inheritance is not taxed. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Surviving spouses are exempt.

Estate Tax Rates Forms For 2022 State By State Table

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

Washington State Inheritance Tax What You Need To Know The Harbor Law Group

Repeal The New Jersey Inheritance Tax

Follow Income Tax Small Business Estate Planning S Ltwlaw Latest Tweets Twitter

Open Sky Policy Institute Questions Blueprint Nebraska E P I C Tax Proposals Latest Headlines Lexch Com

Where S My State Refund Track Your Refund In Every State

New Nebraska Property Tax Law May Be Prompting Closer Look At Rates

How Much Is Inheritance Tax Probate Advance

How Much Is Inheritance Tax Probate Advance

The Differences Between Estate And Inheritance Taxes Rodgers Associates

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Estate Tax Rates Forms For 2022 State By State Table

Florida Estate Tax Rules On Estate Inheritance Taxes

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com

Nebraska Legislature Passes Bill Reducing Inheritance Taxes Regional Government Journalstar Com